Merchant Presented Mode: Domestic QR

Overview

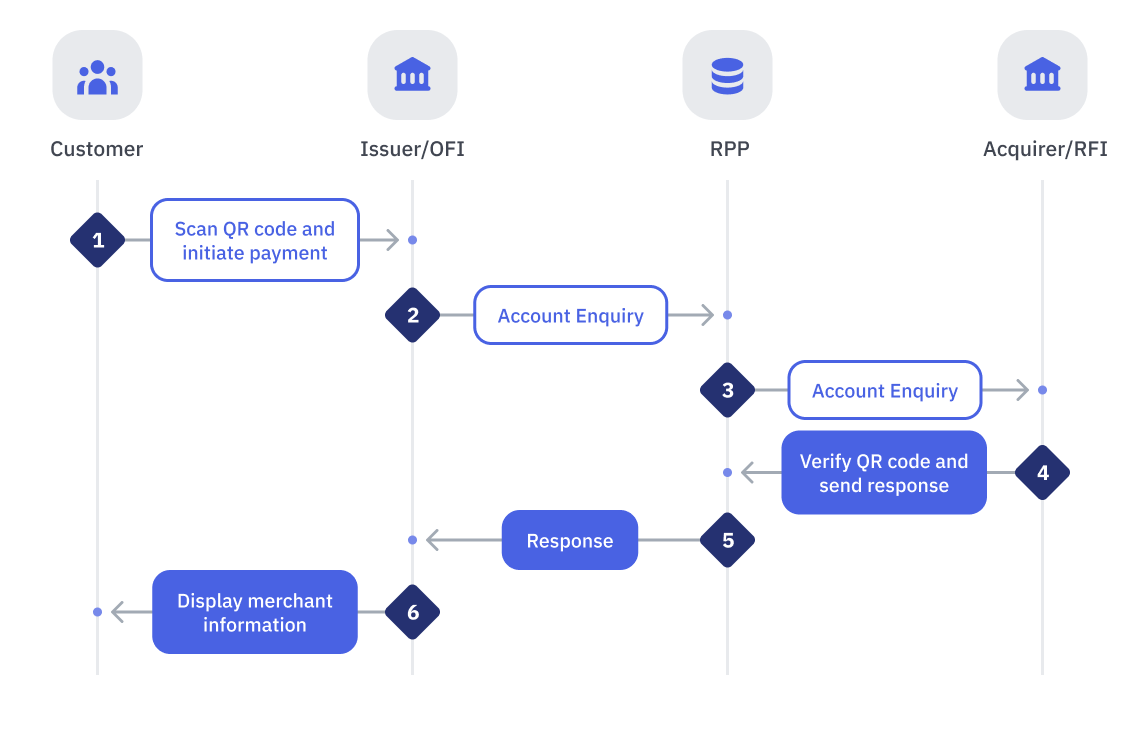

Account Enquiry Flow (Steps 1-6)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 1 | Customer | Issuer | Customer scans a merchant’s QR code via Issuer’s Mobile App and initiates a QR Payment request. |

| 2 | Issuer | RPP | Issuer performs the following:

|

| 3 | RPP | Acquirer | RPP performs the following: If any Message Validation fails, RPP will send a REJECT response to Issuer. If any Business Validation fails, RPP will send a NEGATIVE response to Issuer. If all validations are successful, RPP will:

|

| 4 | Acquirer | RPP | Acquirer performs the following: If any Message Validation fails, Acquirer will send a REJECT response to RPP. If any Business Validation fails, Acquirer will send a NEGATIVE response to RPP. If all validations are successful, Acquirer will send a SUCCESSFUL response to RPP. Notes:

|

| 5 | RPP | Issuer | RPP performs the following:If all validations are successful, RPP will:

|

| 6 | Issuer | Customer | Issuer performs the following:If all validations are successful, Issuer will:

|

Exception Handling

| Step(s) | Event | Action |

|---|---|---|

| 2 | Timeout - No response from RPP | RPP:

Issuer:

|

| 2 | Rejection - Rejected by RPP | RPP:

Issuer:

|

| 3 | Timeout - No response from Acquirer | Where no response is received from Acquirer after X period of time, the following steps should be taken: RPP performs the following:

Issuer performs the following:

If all validations are unsuccessful, Issuer will display an error message on the customer screen. |

| 3 | Rejection - Rejected by Acquirer | Acquirer:

RPP:

If all validations are unsuccessful, Issuer will display an error message on the customer screen. |

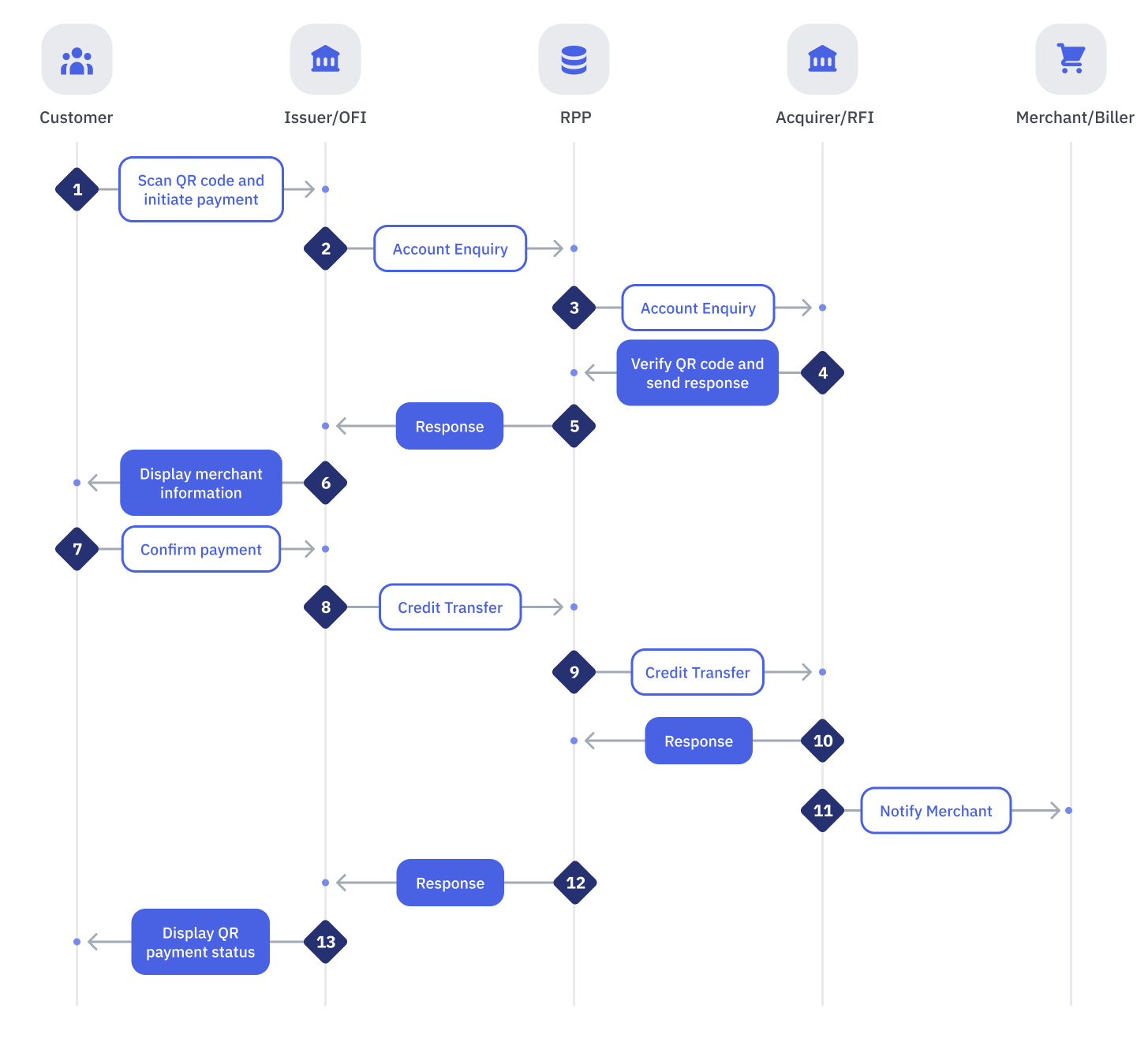

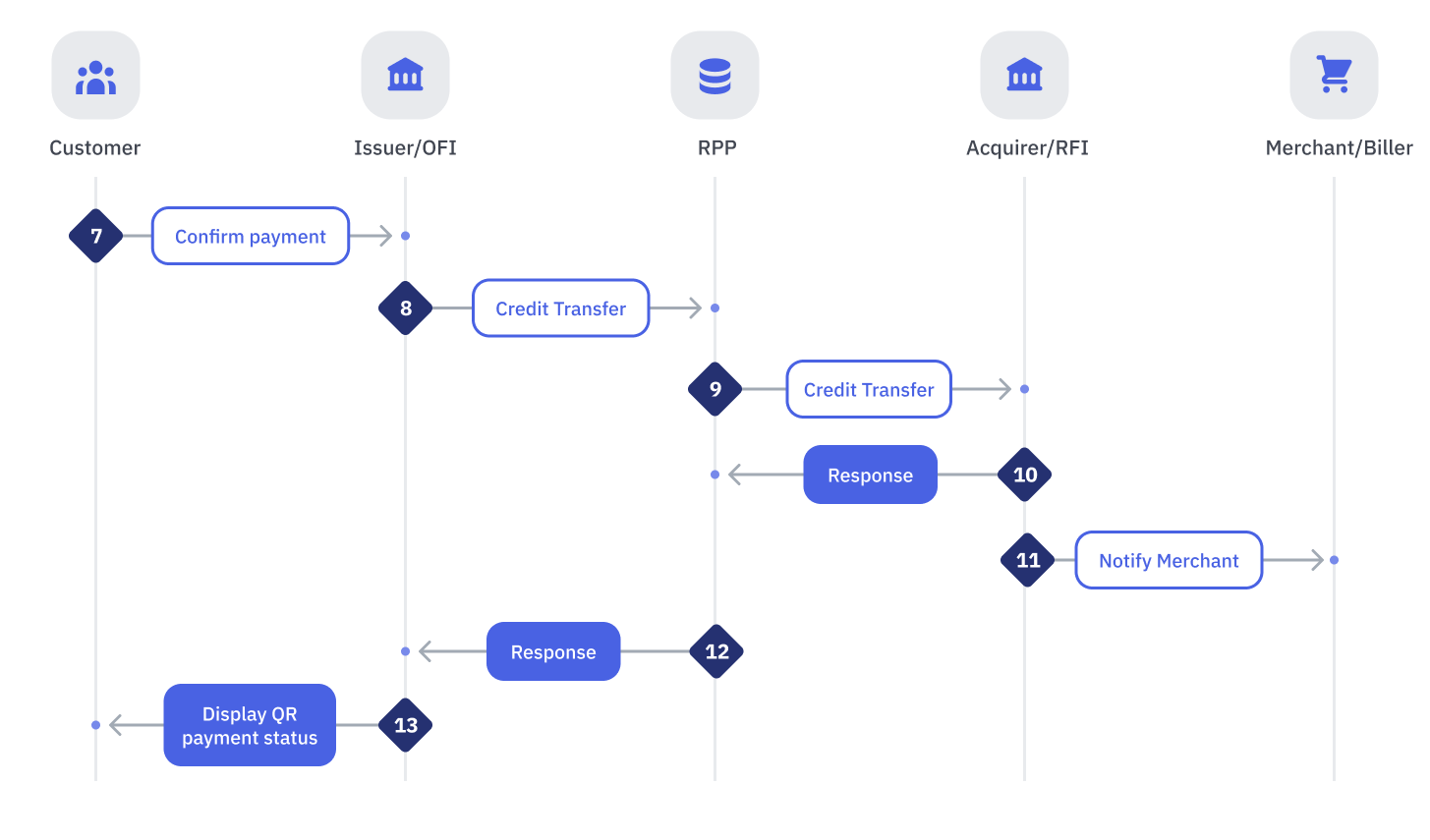

Credit Transfer Flow (Steps 7-13)

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 7 | Customer | Issuer | Customer confirms the QR Payment. |

| 8 | Issuer | RPP | Issuer performs the following:

|

| 9 | RPP | Acquirer | RPP performs the following: If any Message Validation fails, RPP will send a REJECT response to Issuer. If any Business Validation fails, RPP will send a NEGATIVE response to Issuer. If all validations are successful, RPP will proceed to:

|

| 10 | Acquirer | RPP | Acquirer performs the following: If any Message Validation fails, Acquirer will send a REJECT response to RPP. If any Business Validation fails, Acquirer will send a NEGATIVE response to RPP. If all validations are successful, Acquirer will:

|

| 11 | Acquirer | Merchant | Acquirer notifies Merchant on successful QR Payment status. |

| 12 | RPP | Issuer | RPP performs the following:If all validations are successful, RPP will:

|

| 13 | Issuer | Customer | Issuer performs the following:If all validations are successful, Issuer will:

|

Exception Handling

| Step(s) | Event | Action |

|---|---|---|

| 8 | Timeout - No response from RPP | When no response is received from RPP after X period of time, the following steps should be taken: Issuer (Step 9):

RPP (Step 10):

If any Message Validation fails, RPP will send a REJECT Response to Issuer. If all validations are successful, RPP will send the Transaction Enquiry Response to Issuer. Issuer (Step 11):

|

| 8 | Rejection - Rejected by RPP | RPP:

Issuer

If all validations are unsuccessful, Issuer will display an error message on the customer screen. |

| 9 | Timeout - No response from Acquirer | When no response is received from Acquirer after x period of time, the following actions will be taken: RPP:

Issuer:

If all validations are successful, Issuer will display a successful message on the customer screen. NOTE: If the signature received from RPP could not be verified, Issuer will base the status of the transaction on the actual transaction status received from RPP. |

| 9 | Rejection - Rejected by Acquirer | Acquirer:

RPP:

If all validations are unsuccessful, Issuer will display an error message on the customer screen. |

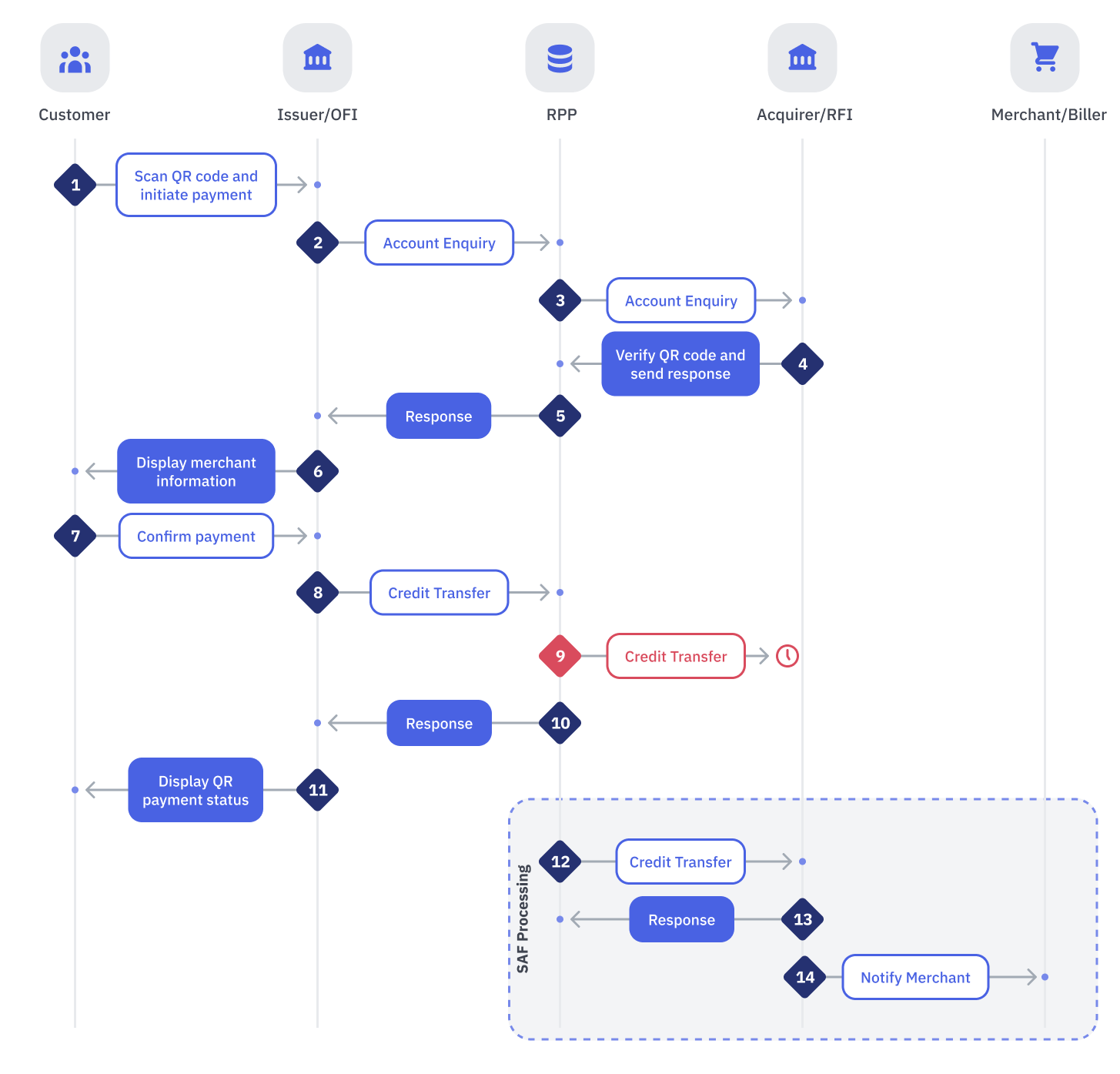

SAF Processing Flow

| Step | Sender | Receiver | Process |

|---|---|---|---|

| 12 | RPP | Acquirer | For SAF transactions, RPP will:

Note: Reconciliation base on SAF report might be required. |

| 13 | Acquirer | RPP | Acquirer performs:

If any Message Validation fails, Acquirer will send a REJECT response to RPP. If all validations are successful, Acquirer will send a SUCCESSFUL response to RPP. Note: Acquirer CANNOT reject transactions coming from the SAF queue. |

| 14 | Acquirer | Merchant | Acquirer notifies merchant on successful QR Payment status. |

Validation Rules

| Message Validation | Business Validation |

|---|---|

| RPP:

Acquirer:

|